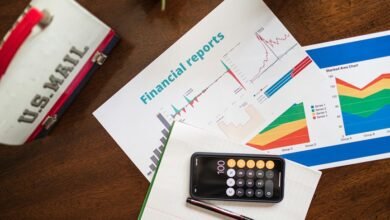

Experts Aigilbertwired Must-Own Stocks for Today’S Market

Experts at Aigilbertwired emphasize the importance of identifying resilient stocks amid current market volatility. They highlight sectors such as technology, healthcare, and consumer staples for their stability and growth potential. Strategic selection based on robust fundamentals and consistent dividend growth can provide a safeguard against unpredictable swings. For investors seeking long-term security and income, understanding these core areas and top picks becomes essential—leaving questions about specific strategies and stock choices to be explored further.

Key Sectors to Watch in Today’s Market

In the current market environment, certain sectors demonstrate heightened resilience and growth potential, making them critical areas for investor attention.

Amid market volatility, sector diversification offers strategic stability and opportunity for those seeking financial freedom.

Identifying sectors with strong fundamentals enhances resilience, enabling investors to navigate fluctuations confidently and capitalize on emerging trends.

Top Stock Picks According to Aigilbertwired

Building on the recognition of resilient sectors, Aigilbertwired has identified specific stocks that stand out due to their robust fundamentals and growth prospects. These top picks demonstrate consistent dividend growth, providing stability amid market volatility.

For investors seeking freedom from uncertainty, these stocks offer a strategic advantage, balancing risk management with long-term wealth accumulation.

Strategies for Investing in Today’s Market Conditions

Given the current market volatility and economic uncertainties, adopting a disciplined and data-driven investment approach is essential for navigating today’s conditions.

Emphasizing dividend investing offers stability and income, enabling investors to maintain financial independence.

Strategic allocation and diversification mitigate risks, empowering individuals to pursue freedom while safeguarding assets amidst unpredictable market fluctuations.

Conclusion

In a landscape marked by volatility, selecting stocks with robust fundamentals offers stability akin to a steady anchor amid turbulent waters. While resilient sectors like technology, healthcare, and consumer staples serve as safe harbors, disciplined, data-driven strategies enable investors to navigate uncertainties confidently. Balancing growth potential with income streams creates a resilient portfolio—transforming market unpredictability from a threat into an opportunity for strategic advantage and long-term wealth accumulation.